The Future of Real Estate —

Accessible, Transparent, and Digitally Enabled

Introduction: Expanding Access to Real Estate Investment

At Pillar Properties, we are introducing an investment model where interests in select properties are represented as digital tokens recorded on secure blockchain technology. This approach can allow smaller investment sizes and provide potential flexibility for investors, while maintaining compliance with U.S. securities laws.

What is Tokenization?

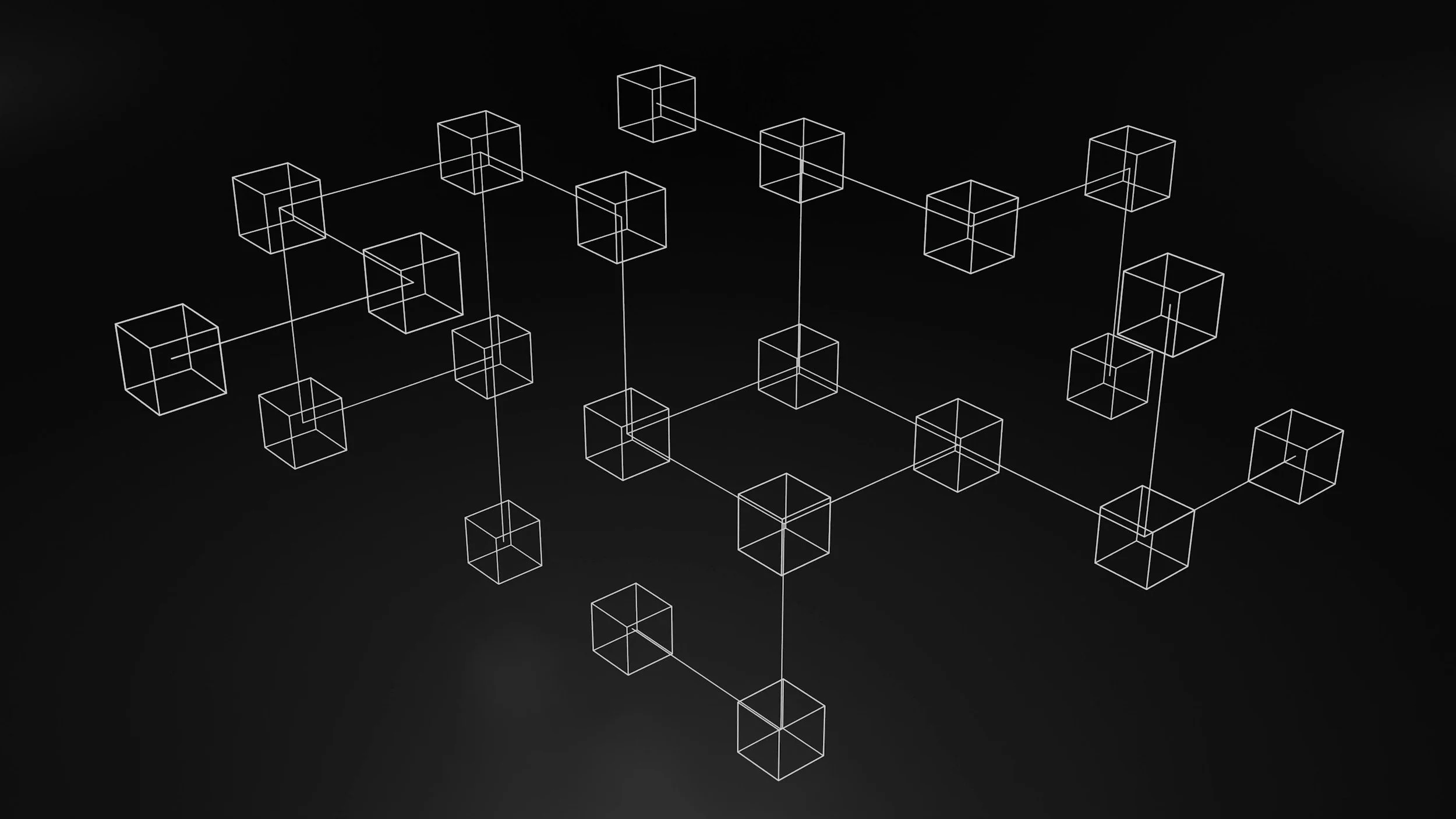

Tokenization is the process of representing an ownership interest in a real estate holding company as a digital token.

How Does it Work?

Blockchain acts as a secure, distributed ledger to record token transactions. Certain administrative functions, such as income allocation and compliance checks, may be automated through pre-programmed “smart contracts.”

Before You Invest — Understand the Risks

-

Market & Liquidity Risk: Real estate values can decline, and secondary market trading may be limited or unavailable.

-

Regulatory Risk: The legal landscape for digital assets is evolving and could change.

-

Technology & Cybersecurity Risk: Blockchain and smart contracts may be subject to operational vulnerabilities.

-

Tax Considerations: Investments may require issuance of Schedule K-1 tax forms and could involve multi-state tax filings. Consult a qualified tax advisor.

Potential Advantages of Our Approach

-

Fractional Ownership: Lower minimum investment amounts compared to traditional direct real estate ownership, allowing more investors to participate.

-

Liquidity Potential: Once available, tokens may be eligible for trading on regulated alternative trading systems (ATS). Any trading activity depends on platform availability and market demand.

-

Transparency & Security: Blockchain records create a verifiable, tamper-resistant history of token transactions.

-

Operational Efficiency: Certain administrative steps can be streamlined through automated smart contracts, potentially lowering costs and reducing processing time.

FAQs

How is tokenized real estate different from traditional investing?

Tokenization allows ownership interests to be represented as digital tokens on blockchain, potentially enabling smaller investment sizes and faster transaction processing.

Can I sell my tokens whenever I want?

Liquidity is not guaranteed. Tokens may be eligible for trading on regulated secondary markets once such platforms are available and operational.

Do I own part of the actual property?

Tokens represent equity in the LLC that owns the property, not a direct deed interest.

How do I receive income?

If and when distributions are declared, smart contracts may facilitate allocation to token holders.

What about taxes?

Investors may receive Schedule K-1 forms for tax reporting and may be subject to multi-state filing requirements. Consult a qualified tax professional.

.